Award-winning PDF software

Form 982 online Clarksville Tennessee: What You Should Know

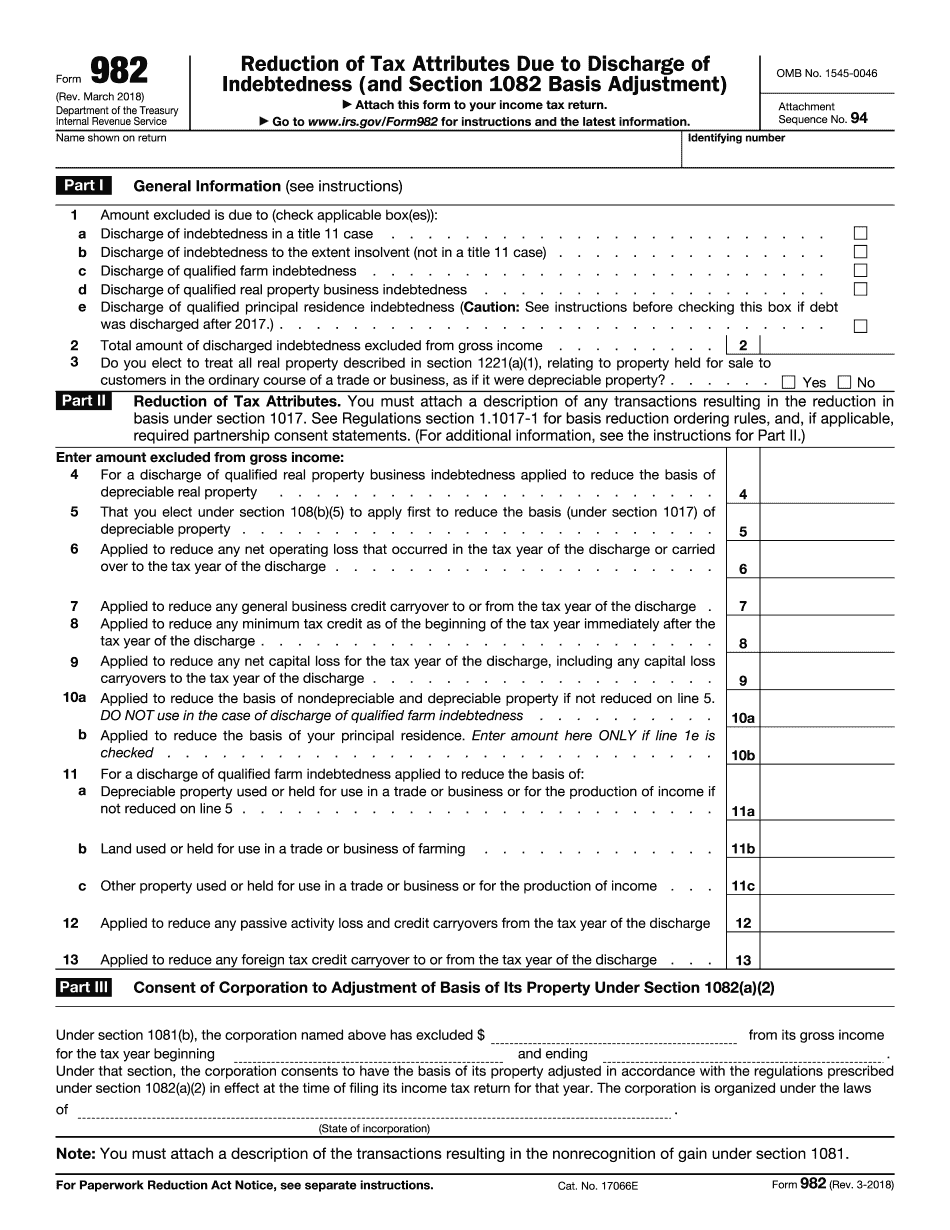

Tax Preparation | Ext: 3124 A.R.S. Sec. 66.010 (3)(c) (“Amount of indebtedness to be reduced in order to reduce or eliminate tax liability”) As an alternative to reducing a qualified principal residence debt, you can also file Form 982 in order to reduce the amount of qualified principal residence indebtedness to be included from the gross income of a taxpayer. Amounts not otherwise excluded, to the extent they are includible in gross income, may be reduced by a net operating loss carry forward to reduce the extent to which the basis of such assets is increased or decreased by an exclusion under section 108 from gross income under Sec. 66.010. A qualified principal residence (the property) is any home or other dwelling that is-- ``(1) located in the United States; ``(2) any part of which is located in the United States (or is a primary residence of a domestic corporation (or an estate in which such a domestic corporation is a resident); and ``(3) held by you, if you are a United States citizen or resident, or by a corporation or other entity treated as a domestic corporation (or an estate in which such a domestic corporation is a resident) (or any predecessor of either). The principal residence may be any of the following: The term “qualified principal residence” shall not include-- If, during the taxable year-- ``(1) you had a qualified principal residence in the United States, and (2) you were not able to satisfy the requirements of Sec. 66.010 to reduce a qualified principal residence indebtedness during the taxable year (for example, because you do not have a net operating loss carry forward to reduce such indebtedness), then you may meet the requirements of Sec. 66.010 to reduce a qualified principal residence indebtedness. The amount determined by the Secretary of the Treasury under Sec. 66.010 is reduced by the amount of indebtedness that is treated as excluded from gross income under Sec. 118 or by the amount by which such indebtedness would have been disallowed by the Internal Revenue Service for filing a claim under Sec. 6542 if the interest deduction were applicable to the indebtedness. A debt that is excluded from gross income under Sec. 66.010 because the interest or income is not qualifying interest is treated as a debt not to be reduced under this section, and the reduced amount will not be considered a reduction of any qualifying indebtedness.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 982 online Clarksville Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 982 online Clarksville Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 982 online Clarksville Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 982 online Clarksville Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.