Award-winning PDF software

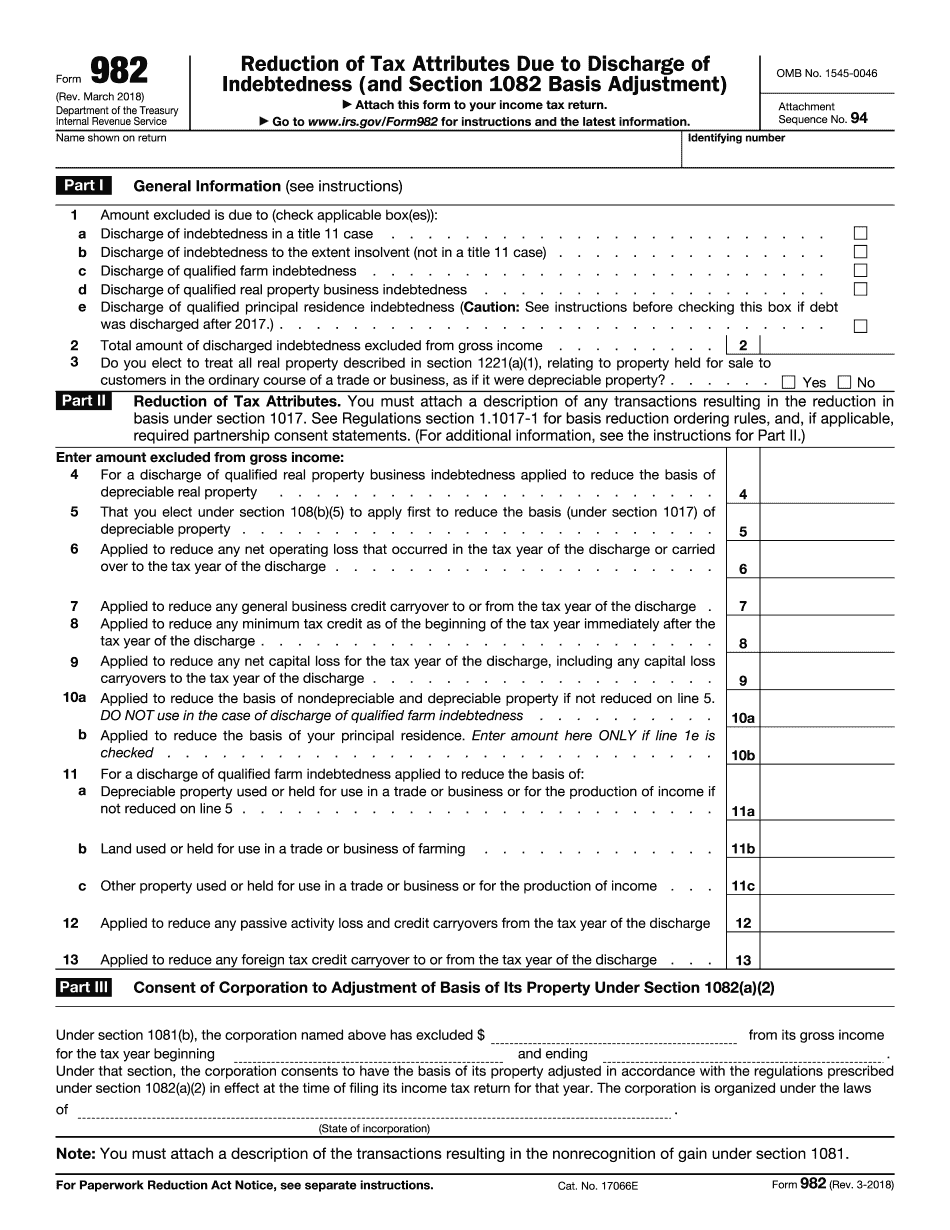

Form 982 for Hollywood Florida: What You Should Know

In general, for each discharge of indebtedness, you include all the income you received from the discharge and any losses. If you have less than 25,000 of debt discharge, the loss does not come from the sale of your home. In that case, the loss is taken from a qualified principal residence, which is taxed as property rather than a personal asset. If you have 25,000 or more of indebtedness, the loss is not included in your income, and you owe any remaining debt. For more information, see the section 6041 of the Taxpayer Handbook. If the debtor is under the age of 65, the debtor's personal exemption is phased out for amounts that are over 13,000. For more information, see Tax Tip 2010-28: What do the IRS, state, and local tax agencies say about the phase-out of estate and inheritance tax exemptions as a result of the estate and death of a debtor? Discharge of qualifying indebtedness: Section 7702 of the Internal Revenue Code allows you to deduct the amount of debt discharged from your income. However, unlike a taxable gain, there are some exceptions you need to know about. Deduction for discharge of a secured debt Only loans that are secured by your principal dwelling or any portion thereof must be carried over to an after-tax basis after discharge. If you bought your home after the date of loan acquisition, your debt may be discharged but because of the property's outstanding balance and the limited period between acquisition and discharge, the amount of the debt would have been taxable at the time. The amount you can discharge depends on the number of years you have owned your home. If the property was acquired on or after January 1, 2005, discharge is limited to the period of time the property has been owned. For information concerning the treatment of the period of time from the date of acquisition until January 1, 2005, see Treasury Inspector General for Tax Administration (TI GTA) Bulletin 2014‑54. If mortgage debt was acquired before January 1, 2005, you may not be able to use Section 7702 if you did not make a gain from the sale.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 982 for Hollywood Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 982 for Hollywood Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 982 for Hollywood Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 982 for Hollywood Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.