Award-winning PDF software

Cary North Carolina online Form 982: What You Should Know

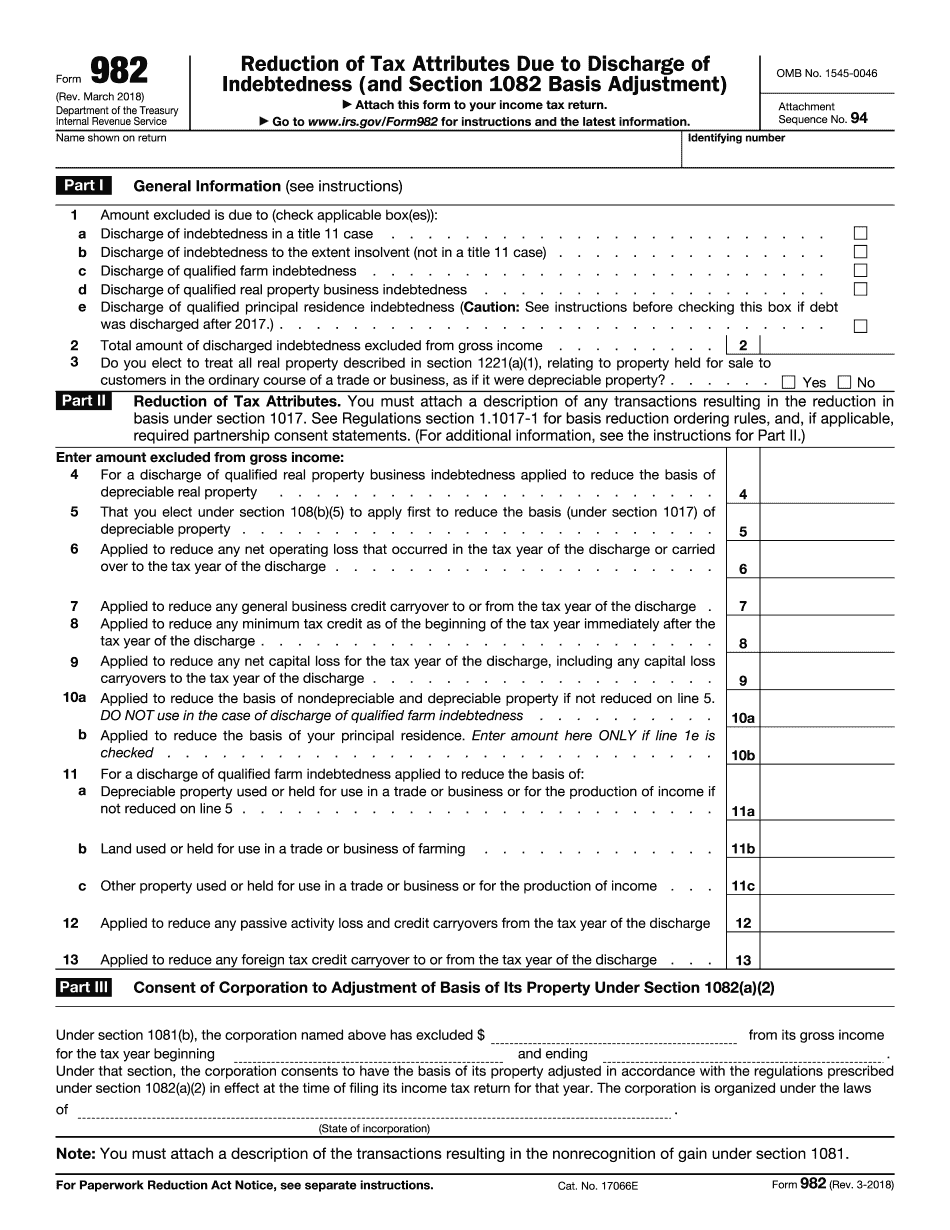

North Carolina court proceedings and providing emotional and other supports that help secure proper child placement, proper and stable parenting, positive relationships, and lasting relationships with the parents and relatives of the child. If you need a “Guardian ad Item” in your court, please call the North Carolina Department of Social Services at or email the Guardian ad Item service at GAF.info. Help with Your NC Income Tax Refund or Credit Application (if applicable) Online Form North Carolina Refund and Credit Assistance Center Your payment processing fees for the tax refund you requested are now being processed. You can use any of the following methods for processing your tax refund or credit application: You can file online through IRS.gov or the North Carolina website. Your refund will be deposited into your bank account in about 3 to 5 days. Apply for Earned Income Tax Credits (EIT Cs) and Child Tax Credits (CTC's) Apply for the ETC and the Child and Dependent Care Credit at North Carolina ETC and CTC Service Center (NE CSC) : You can also visit the IRS.gov website for more information. Forms Available for File in North Carolina You can visit the North Carolina State Taxpayer Office or any of the following locations to have your taxes returned in person. If you are having a problem obtaining your tax forms online because the website is down, please visit the North Carolina State Taxpayer Services Service Center. The address is located at the bottom of the webpage. Filing Status Refund: Paid Credit Application: Paid Form: W-4 — North Carolina Income Tax Return for 2018/2019 and 2017/2018 Forms and Publications Form 982 with electronic signature (if applicable) (if applicable) North Carolina State Taxpayers: When you are filing your tax return, you will need to provide your Social Security Number, your name and a physical mailing address. Your tax return will then be mailed to this mailing address. If you receive your tax returns by mail, fill out and sign the first section of the return for the years in which you will be filing taxes. Fill out and sign the following parts of the return for years in which you will not be filing taxes. In addition to the required parts, you may be asked to fill out a statement stating what information you received from the Division of State Revenue.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cary North Carolina online Form 982, keep away from glitches and furnish it inside a timely method:

How to complete a Cary North Carolina online Form 982?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cary North Carolina online Form 982 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cary North Carolina online Form 982 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.