Award-winning PDF software

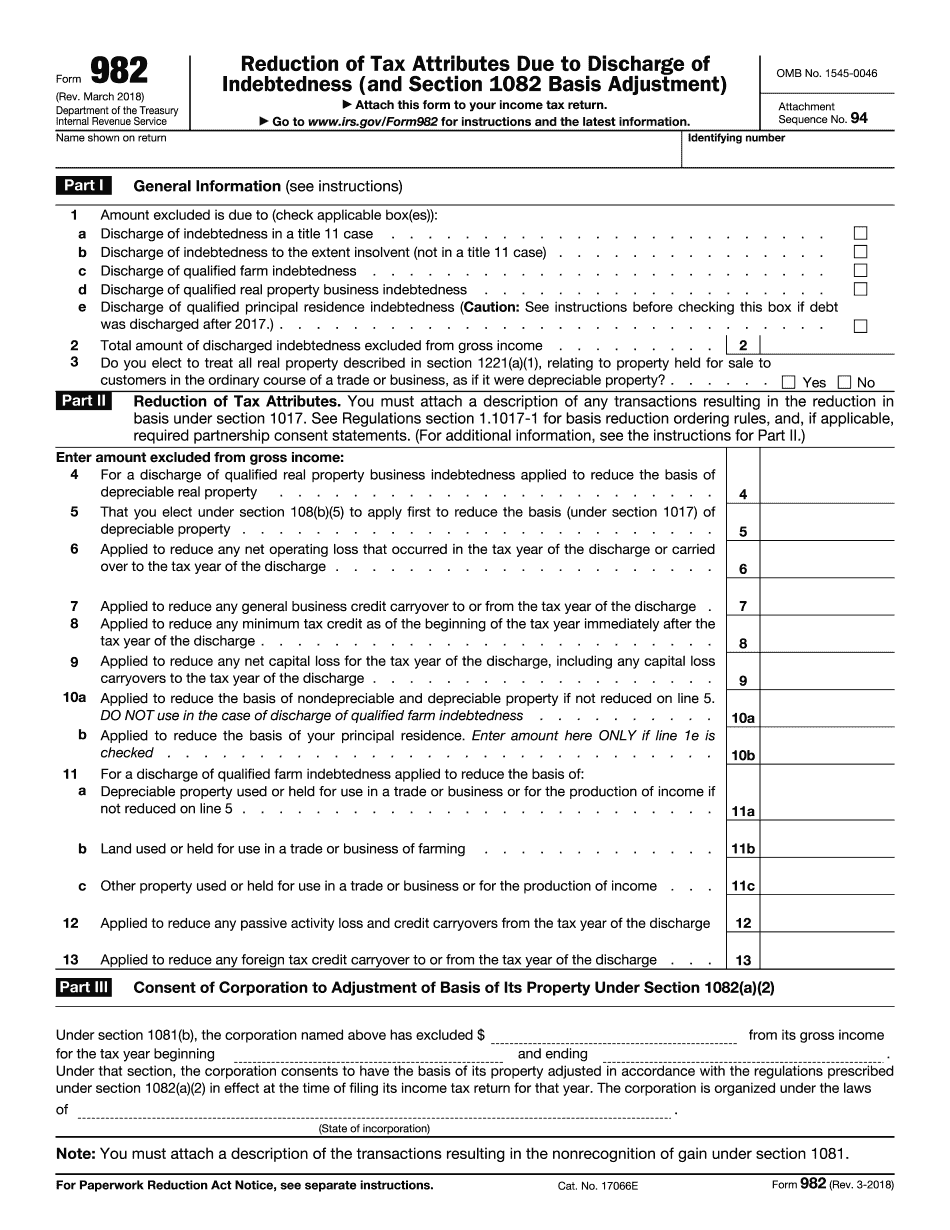

form 982 (rev. march ) - internal revenue service

Make this form available on the IRS website for everyone to use for free. OMB No. .4023-15 ▷ You may receive a copy by submitting this request to the IRS. OMB No. .4023-15 What's this does? An online form designed to create a new income tax credit and interest on a credit or refund you did not qualify for. It will give you an adjusted gross income credit equivalent to the amount of the refund or credit that you received if a credit or refund did not apply to you. If the income tax you paid was not more than 3,000 you can use this form; if over that amount you can use the forms found below. This income tax credit allows you to exclude up to 2,050 of tax paid from your gross income and your adjusted gross income (AGI). You may use this form for an adjusted gross income of 3,000 or.

Federal form 982 instructions - esmart tax

Per 1,000 in debt in 2017 shall be made on or before October 1, 2017, and is effective starting on the first day of the taxpayer's taxable year in which the liability began. The total amount of debt excluded for 2018 from income under this paragraph in any taxable year shall not exceed 3,000 in any one filing status. If the election is made before July 31, 2018, the period for making an election shall begin on the start date of the taxable year in which the debt was incurred and shall expire 30 days thereafter. An election made after the start date provided in this paragraph shall be effective only for the taxable year for which it is made and shall end on the last day of the preceding taxable year. To claim the deduction for interest on debt excluded under this paragraph, see paragraph (b)(8) of this section:.

Form 1099-c - cancellation of debt / form 982 - reduction of tax

The loan is discharged or forgiven, you will not be the owner of the loan; you will simply have transferred ownership of that part of your balance due to the loan. The amount of your debt is transferred from debt to equity. The amount of your outstanding balance is reduced by the amount of your forgiven debt or loan. The amount you can carry is reduced by the amount of your discharge, if any, whether the discharge occurred before or after the date you filed your return, including discharge during the year. When is a Debt Cancellation Refundable? Your refundable portion is equal to the amount you would have paid if the debt had not been cancelled. Example. You borrow 10,000 from a commercial lender, but the loan is cancelled, and you owe only 7,000. On your return for that taxable year, your canceled debt should be 6,000 (10,000.

Proweb: form 1099-c - cancellation of debt / form 982

Net investment income column of the taxpayer's Form 1040, 1040A, or 1040EZ. However, the income and deductions can be reported on other IRS forms, such as the Form 1040Y, 1040Z, or 1040-OID. Form 4562: Income Limitations on Loans Taxpayer's tax returns must list the total amount of indebtedness to any person. For tax years beginning before 2012, the maximum debt is 10,000. For tax years beginning in 2012 or later, the maximum debt is 500,000. Taxpayers should also report other debt if the loan exceeds 10,000, such as a mortgage or a credit card. The taxpayer might need to file an amended return if the new maximum debt exceeds 500,000. In general, taxpayers can't take out more debt than they have borrowed. For example, if a taxpayer can take out only 2,500 in debt in a year, it can't be taken out in total. Form 1045a: Mortgage Interest Deduction The mortgage.

Using form 982 to exclude cancellation of debt income

Oct. 24, 2017 Form 8860, Estimated Income Tax for Single Filers, Single Head of Household, Married Filers Who Are Not Qualifying Widow(ERS), Married Couple who Separate, Qualified Widow(er), Qualified Widow(er) and Qualified Spouse, and Married Taxpayers Who Did Not File a Tax Return for the 2017 Tax Year Form 8860, Estimated Income Tax for Single Filers, Single Head of Household, Married Filers Who Are Not Qualifying Widow(ERS), Married Couple who Separate, Qualified Widow(er), Qualified Widow(er) and Qualified Spouse, and Married Taxpayers Who Did Not File a Tax Return for the 2017 Tax Year The IRS determines what amount of income will be taxed as ordinary income for purposes of the federal tax code based on the taxpayer's filing status and tax rate. Taxpayers can choose to file their federal income tax return as individual, married filing jointly, or married filing separately. The estimated income tax used to adjust the taxpayer's tax liability.