Hey, my name is Steve Parr, and today we are going to talk about the principal residence exemption. The principal residence exemption allows you to sell a property without paying any tax on it. The capital gain that you would normally accrue from the sale of that property doesn't apply. In this video, we want to cover off some of the issues surrounding the principal residence exemption and ensure that if you are thinking about making use of it, you are doing it properly. The first thing to keep in mind is that the exemption needs to be reported. Since 2016, the CRA has required that this exemption be reported on your personal income tax return. Make sure you are working with your accountant to ensure that it is done correctly. The second criteria is that the residence exemption only applies to a property that you actually live in. The CRA uses the term "ordinarily inhabited." While there isn't a specific set number of days that the CRA requires, they will look at factors such as the length of time you are in the property and your sources of income. They will also look into whether the real estate sale was part of another series of transactions, like a real estate flipping venture. The third piece is that if you are using your property to generate income through long-term or short-term rentals, it generally won't qualify for the principal residence exemption. This type of use is considered an investment property. However, there are exceptions. For example, if you are renting out your property for a very short period of time, like a few weeks a year on Airbnb, it could still meet the criteria. It's important to consult with your tax advisor before confirming on that. Lastly, it's important to note that the principal...

Award-winning PDF software

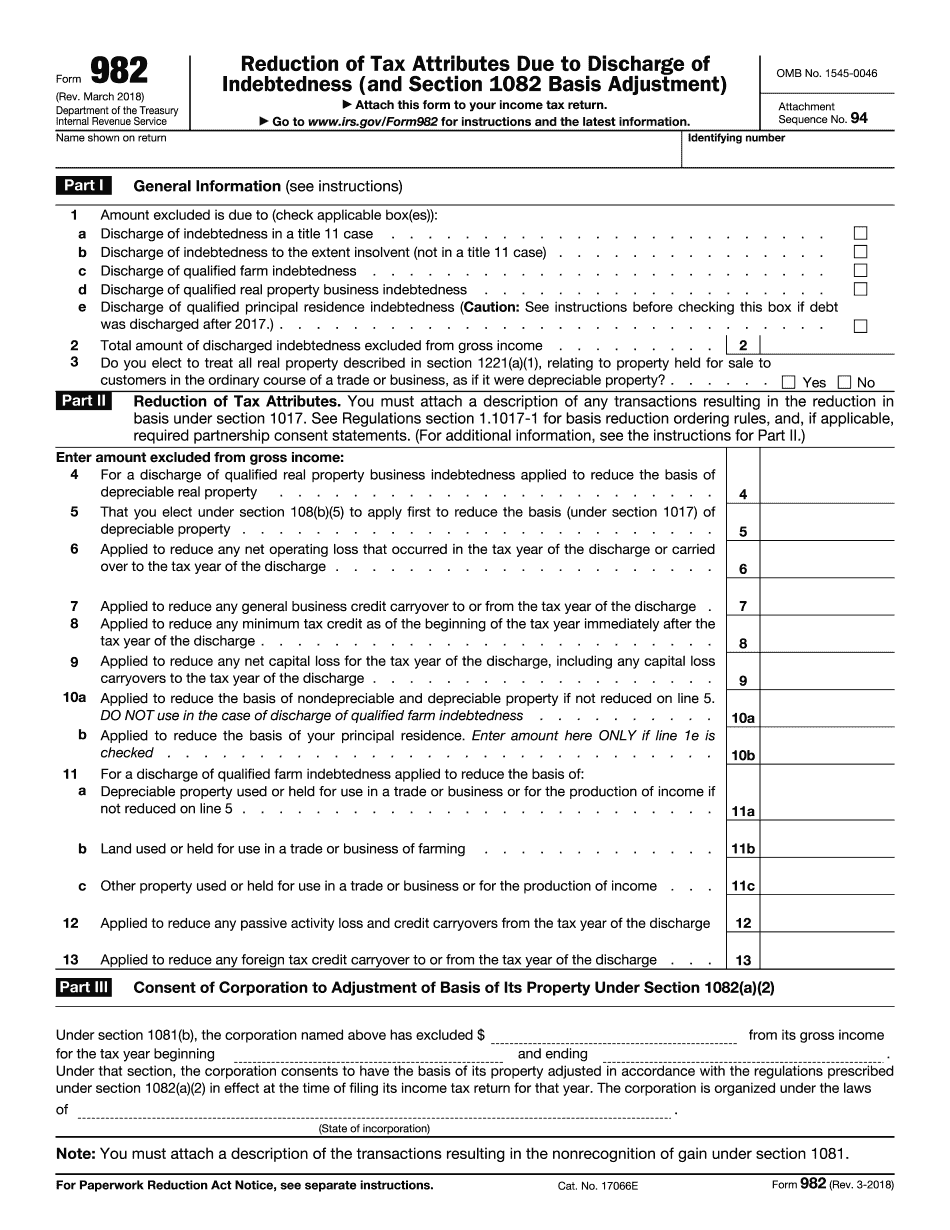

What Is A "discharge Of Qualified Principal Residence Indebtedness"?: What You Should Know

Interest in excess of 2,000,000, or A principal residence located in Montana does not qualify for the exclusion from gross income, but any unpaid principal residence mortgage debt does qualify for a discharge of qualified principal residence indebtedness. Discharge of Mortgage If the payment of some or all payments of a secured debt qualifies for the exclusion from gross income, then a discharge of a mortgage is also eligible. A mortgage discharge is not an eligible property transaction under the mortgage-related exclusions of section 125 of the Code. Discharge of Mortgage Loan If the payments of some or all payments of a secured debt qualified for the exclusion from gross income when the debt was first incurred, and payments of any or all of those payments qualified for the exclusion when the debt was repaid, the following applies to a loan discharge. There will be no deduction for the principal and interest paid on a new mortgage loan. This may be treated as the payment of principal and interest on a prior mortgage loan. If payments of principal and interest on the mortgage are already included in the income of the taxpayer as a deduction, this result may be considered as the deduction of the principal and interest on the mortgage. If a mortgage has been forgiven, tax liability on it does not change after a mortgage discharge. However, the IRS will generally be able to use the forgiven loan to satisfy other requirements. A loan discharge will not reduce the balance on a loan.

Online methods make it easier to to prepare your document management and supercharge the productiveness of your workflow. Observe the short information to be able to full What is a "discharge of qualified principal residence indebtedness"?, refrain from errors and furnish it in a very timely fashion:

How to complete a What is a "discharge of qualified principal residence indebtedness"? on the internet:

- On the website while using the type, click on Initiate Now and move to your editor.

- Use the clues to complete the related fields.

- Include your own facts and phone data.

- Make convinced that you enter suitable facts and numbers in suitable fields.

- Carefully verify the subject matter from the kind also as grammar and spelling.

- Refer to assist segment when you've got any concerns or address our Service team.

- Put an digital signature with your What is a "discharge of qualified principal residence indebtedness"? with the support of Indication Tool.

- Once the shape is accomplished, push Completed.

- Distribute the prepared sort through e mail or fax, print it out or help you save on your equipment.

PDF editor will allow you to make adjustments to the What is a "discharge of qualified principal residence indebtedness"? from any online world connected gadget, customize it in accordance with your preferences, sign it electronically and distribute in different approaches.

Video instructions and help with filling out and completing What Is A "discharge Of Qualified Principal Residence Indebtedness"?